The Hidden Economics of Cloud Hosting: How Providers Actually Make Money

A CFO once told me his cloud bill made no sense.

His company was spending $47,000 monthly on AWS. When he broke it down, compute was only 31% of the total. The rest? Data transfer, storage IOPS, load balancer hours, and something called "NAT Gateway processing."

"I thought we were buying servers," he said. "Turns out we're paying for air."

That conversation revealed something most executives miss: cloud providers don't make money the way you think they do.

Why This Matters

Understanding cloud economics isn't just for finance teams. It's strategic intelligence.

When you know how providers profit, you negotiate better contracts. You architect systems that avoid margin traps. You predict pricing changes before they hit your budget.

The global cloud market will hit $2.26 trillion by 2030. AWS alone generates $100+ billion annually. That money comes from somewhere—and understanding where gives you leverage.

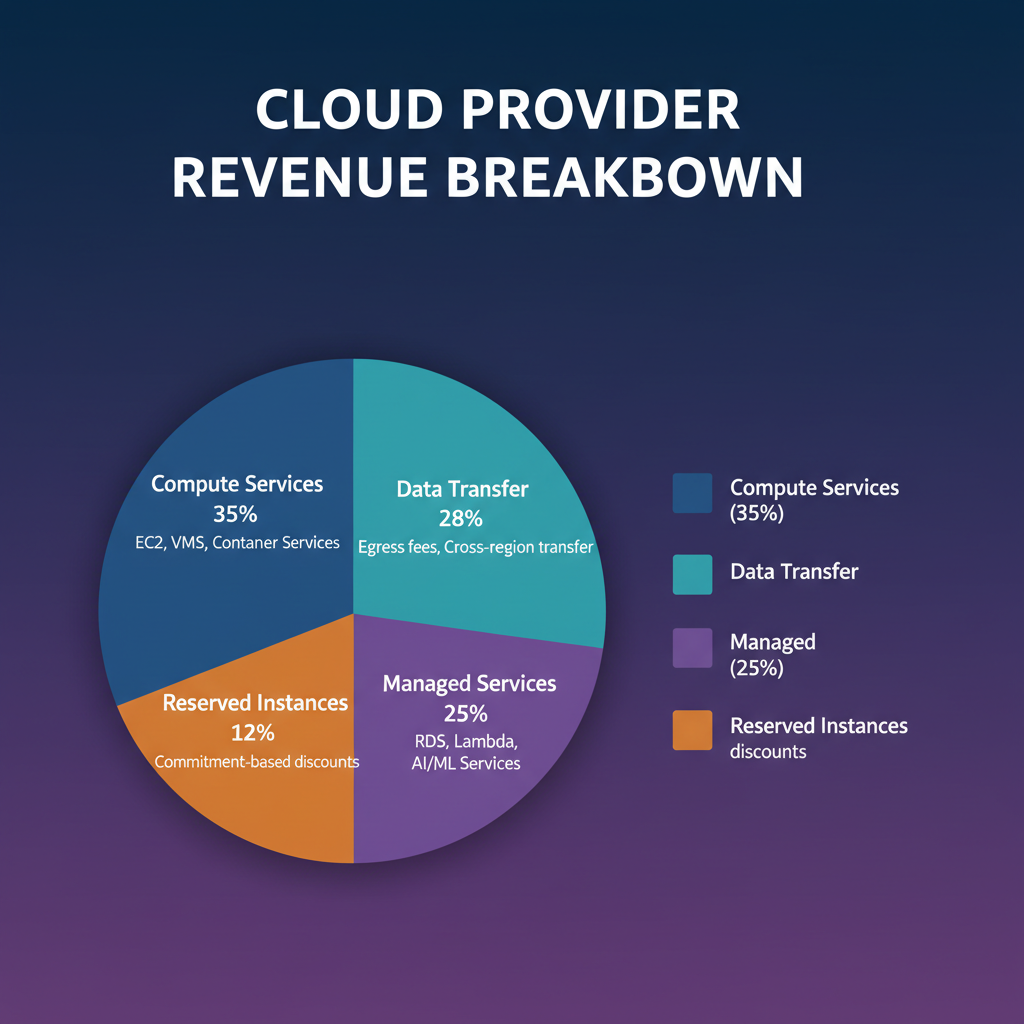

How cloud providers distribute revenue across different service categories

The Real Cost Structure Behind Your Cloud Bill

Here's what most people don't realize: running cloud infrastructure is brutally expensive.

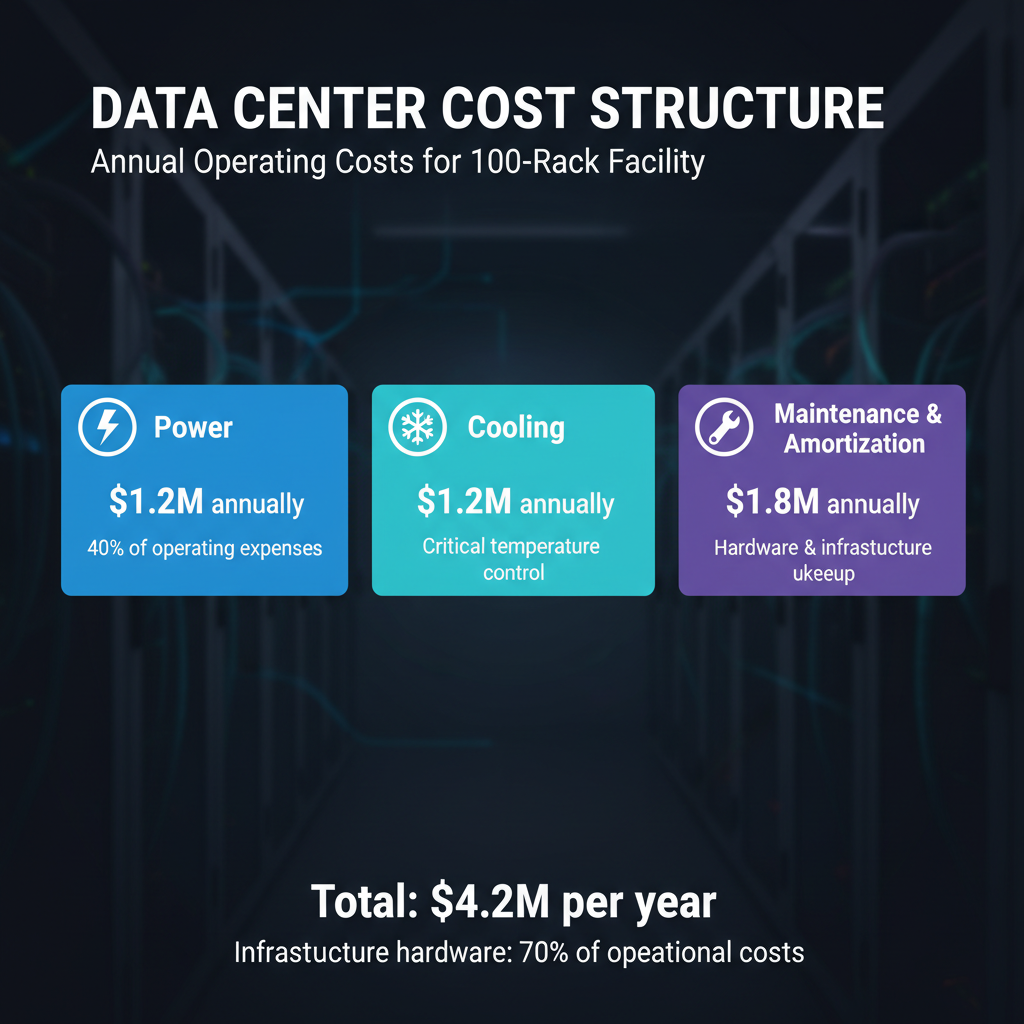

A typical 100-rack data center burns through:

- $1.2 million annually on power

- $1.2 million annually on cooling

- $1.8 million annually on maintenance and amortization

Energy alone accounts for 40% of operating expenses. Infrastructure hardware—servers, networking, storage—consumes up to 70% of operational costs.

Breaking down the massive operational costs of running cloud infrastructure

Yet AWS maintains 25% profit margins. How?

Scale economics and pricing architecture.

The hyperscalers (AWS, Azure, GCP) spread fixed costs across millions of customers. Smaller providers can't match this efficiency—which is why they struggle to compete on price.

The Four Ways Cloud Providers Actually Make Money

1. The Compute Foundation (The Loss Leader)

Basic compute—your EC2 instances, your droplets—often operates on thin margins. Providers use competitive compute pricing to acquire customers, knowing the real profit comes elsewhere.

Think of it like a grocery store selling milk below cost. You come for the milk. You leave with $200 in groceries.

2. The Data Tax (Where Margins Explode)

Here's the hidden profit center: egress charges.

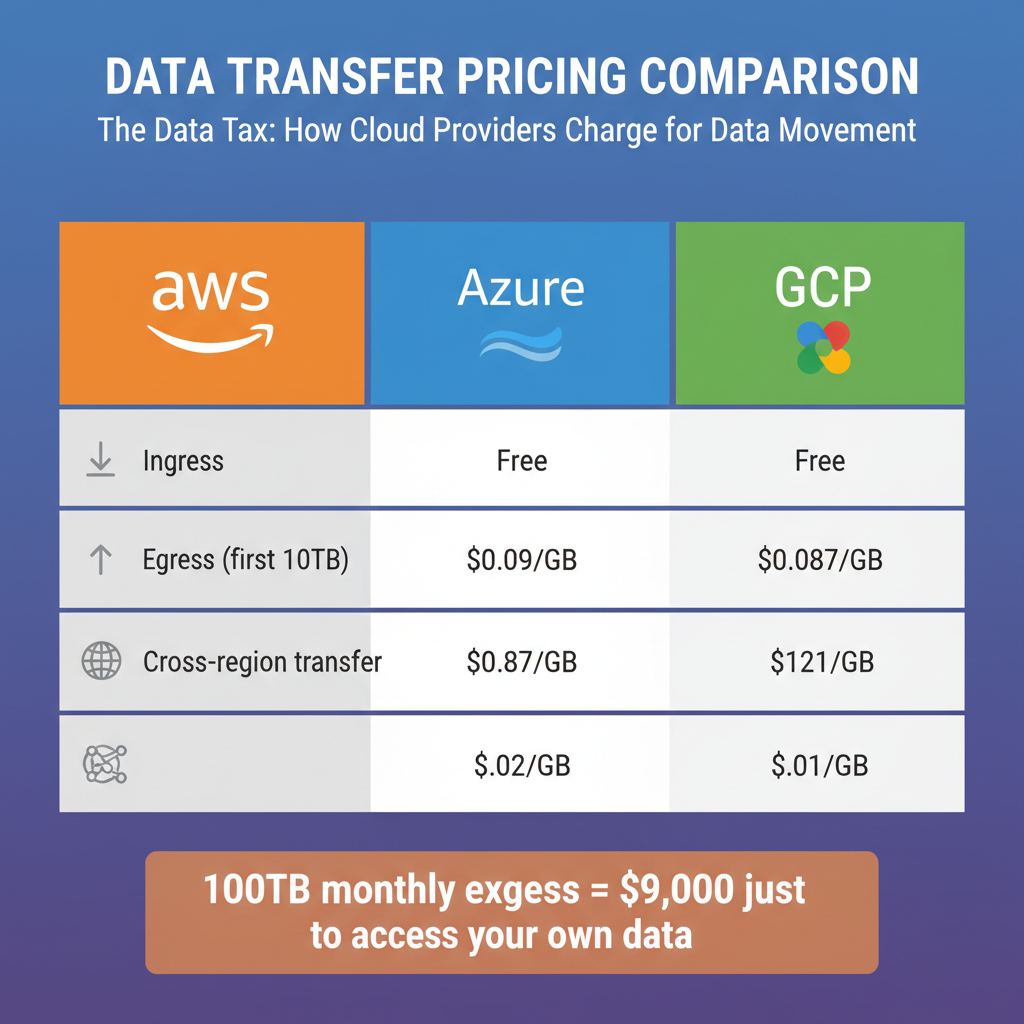

Moving data into AWS is free. Moving it out costs $0.09 per GB. At scale, this becomes substantial. A company transferring 100TB monthly pays $9,000 just to access their own data.

This pricing creates lock-in by design. Migration becomes expensive. Competitors become inaccessible.

| Data Movement | AWS Cost | Azure Cost | GCP Cost |

|---|---|---|---|

| Ingress | Free | Free | Free |

| Egress (first 10TB) | $0.09/GB | $0.087/GB | $0.12/GB |

| Cross-region transfer | $0.02/GB | $0.02/GB | $0.01/GB |

How the three major cloud providers charge for data movement—the hidden tax on your cloud usage

3. The Managed Services Premium

Raw compute is commoditized. Managed services are not.

RDS costs 30-50% more than running your own database on EC2. But it eliminates patching, backups, and 3 AM alerts. Most teams pay happily.

This is where cloud economics shift from infrastructure arbitrage to operational value. The more complex the service, the higher the margin.

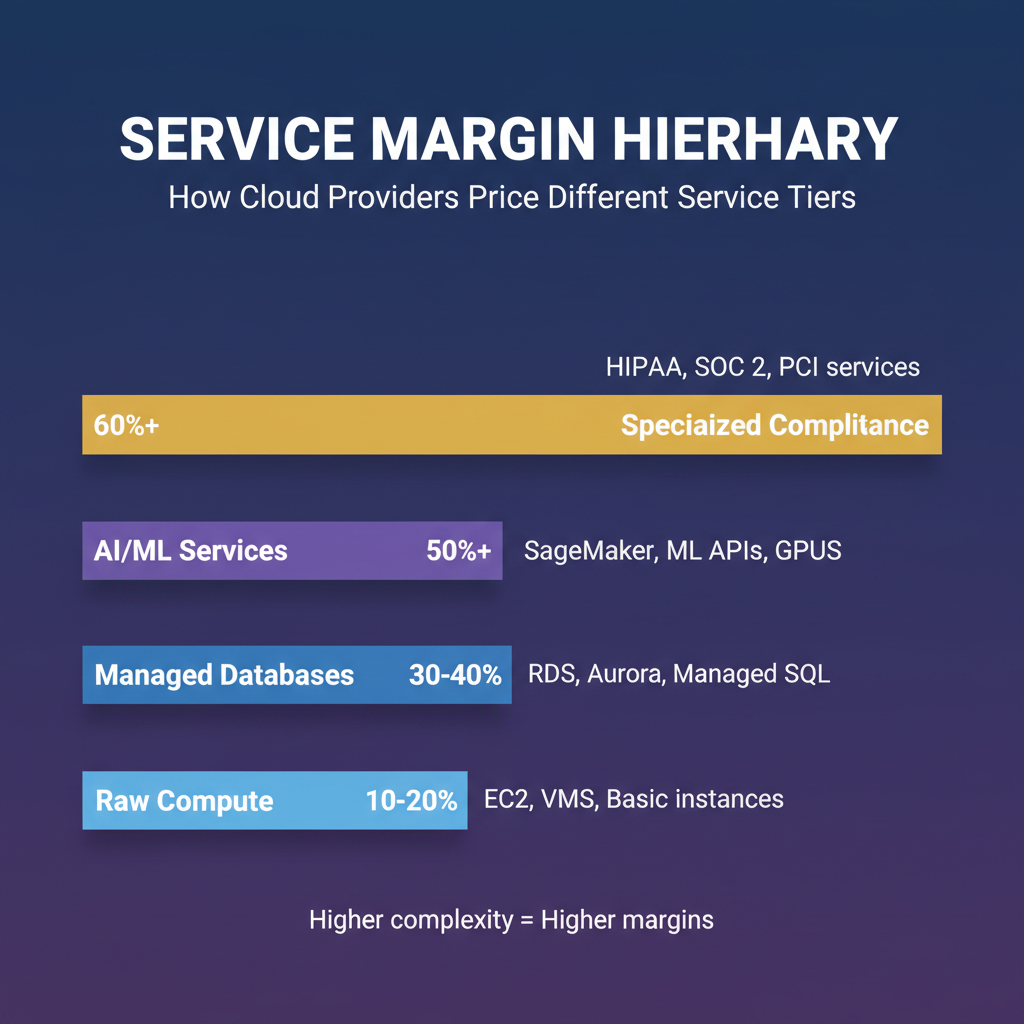

Margin hierarchy:

- Raw compute: 10-20%

- Managed databases: 30-40%

- AI/ML services: 50%+

- Specialized compliance services: 60%+

The more complex the service, the higher the profit margin for providers

4. The Commitment Trap

Reserved instances and savings plans offer discounts up to 72%. Sounds great—until you realize what you're trading.

You're giving providers guaranteed revenue and reduced churn. They're giving you a discount on services you might not fully use.

AWS doesn't offer 72% discounts out of generosity. They do it because committed customers have 7-12 year payback periods baked into their infrastructure planning.

Understanding the four main cloud pricing models and their trade-offs

The Strategic Implications

For CFOs: Your cloud bill is a negotiation surface, not a fixed cost. Understand which line items carry margin, and push back on egress and premium services.

For CTOs: Architecture decisions are financial decisions. Multi-cloud reduces lock-in but increases complexity. Single-cloud maximizes discounts but maximizes dependency.

For Product Leaders: Feature velocity has cloud cost implications. Every new service integration adds billing dimensions. Build cost awareness into sprint planning.

The Builder's Takeaway

Cloud providers aren't charities. They're businesses optimizing for margin like any other.

The difference between a $50K and $150K monthly cloud bill often isn't usage—it's architecture. Teams that understand provider economics design systems that avoid margin traps.

Your next move: Pull your last three cloud invoices. Identify which line items grew fastest. Those are your provider's profit centers—and your optimization targets.

The most expensive cloud decision isn't which provider you choose. It's how well you understand the one you're already using.