How to Build Product Strategy in Highly Technical Markets (Cloud, Infra, AI)

Six years ago, I watched a Series C infrastructure startup lose a $2M enterprise deal to a competitor with objectively worse performance.

Their database was 10x faster. Their uptime SLA was better. Their pricing was more competitive.

But the senior engineer evaluating both products spent three hours trying to get their proof-of-concept working. The documentation was incomplete. The error messages were cryptic. The setup scripts failed silently.

The competitor? Their POC worked in 15 minutes with clear, copy-paste examples.

The engineer chose worse technology with better developer experience.

This wasn’t an isolated incident—it’s the defining pattern of technical markets in 2025.

Why Traditional Product Strategy Fails in Technical Markets

When your buyers can read your code, benchmark your performance, and fork your repository, the rules change completely.

Traditional product strategy frameworks—designed for business buyers who care about ROI and executive dashboards—fall apart when your evaluator is a senior engineer who will spend Saturday night stress-testing your API.

Technical excellence is table stakes, not differentiation. Performance, reliability, scalability? Those get you considered. They don’t win deals.

This article reveals the frameworks, strategies, and lessons from companies like AWS, Vercel, Stripe, and Anthropic that actually win in technical markets. You’ll learn how to navigate bottom-up adoption, build developer-first products, and create sustainable competitive advantages in cloud, infrastructure, and AI.

What Makes Technical Markets Fundamentally Different

Building product strategy for technical markets requires understanding that your buyers operate under completely different mental models than traditional B2B purchasers.

Sophisticated, Skeptical Buyers Who Can Read Your Code

Engineers and developers are perhaps the most discerning buyers in any market. They don’t just evaluate your marketing promises—they benchmark your performance, audit your security, read your source code, and test edge cases you never documented. According to Forrester Research, 3 out of 4 technical buyers prefer to educate themselves rather than talk to a salesperson, and they’ll form opinions about your product before your sales team even knows they exist.

This creates a fundamental shift: traditional product marketing focused on benefits and business outcomes doesn’t resonate. Technical buyers want architectural details, performance benchmarks, integration complexity, and honest discussions about limitations.

Bottom-Up Adoption Patterns That Bypass Traditional Procurement

The enterprise buying motion has inverted in technical markets. Instead of top-down sales cycles starting with executive buyers, adoption begins with individual developers who discover your product through technical content, try it using self-service trials, and gradually expand usage across teams. Only after significant organic adoption do procurement and executive stakeholders get involved.

Atlassian pioneered this approach, believing that a friction-free, product-led distribution process was essential to accelerate adoption of new technology amongst developers. The result? They built a multi-billion dollar business without a traditional sales team for years.

This bottom-up motion means your product must sell itself through technical merit and developer experience long before any sales conversation happens.

Technical Excellence as Minimum Requirement, Not Differentiation

Performance, reliability, and scalability aren’t competitive advantages in technical markets—they’re minimum requirements to be considered. When Snowflake entered the data warehousing market, their core value proposition wasn’t just being “fast”—it was being orders of magnitude faster while also separating compute and storage, enabling true pay-per-use economics.

The bar for technical excellence is extraordinarily high because your buyers can and will benchmark you against competitors. They’ll run load tests, measure latency, analyze cost efficiency, and share results publicly in technical communities.

Developer Experience as Your True Moat

Where does differentiation come from if not technical features? Increasingly, the answer is developer experience (DX). Research shows that DX dictates adoption velocity, implementation costs, and long-term viability more than almost any other factor. It’s the hidden lever that supercharges adoption and amplifies network effects over time.

Companies like Stripe understood this early. They didn’t just build a payments API—they built the best-documented, easiest-to-integrate, most developer-friendly payments experience in the world. Their documentation included copy-paste code samples for every major language, interactive examples, and comprehensive error handling. The result? Developers became vocal advocates, and Stripe’s API-first strategy became the gold standard for developer tools.

Key Statistics That Define Technical Markets in 2024-2025

- Cloud infrastructure spending reached $99 billion in Q2 2025, growing 25% year-over-year, with AI workloads driving significant expansion

- 98% of organizations are actively exploring generative AI, with 39% already deploying it in production

- 38% of SaaS companies now use usage-based pricing, aligning costs directly with value delivered

- 59% of software companies expect usage-based approaches to grow as a percentage of overall revenue in 2025, an 18% rise from 2023

- Google Cloud achieved 13% market share in Q2 2025, becoming the fastest-growing major provider largely due to its focus on AI and data analytics

These dynamics create unique challenges and opportunities. The companies that win aren’t necessarily those with the best technology—they’re the ones who master the intersection of technical excellence, developer experience, and product-led growth strategies tailored for technical buyers.

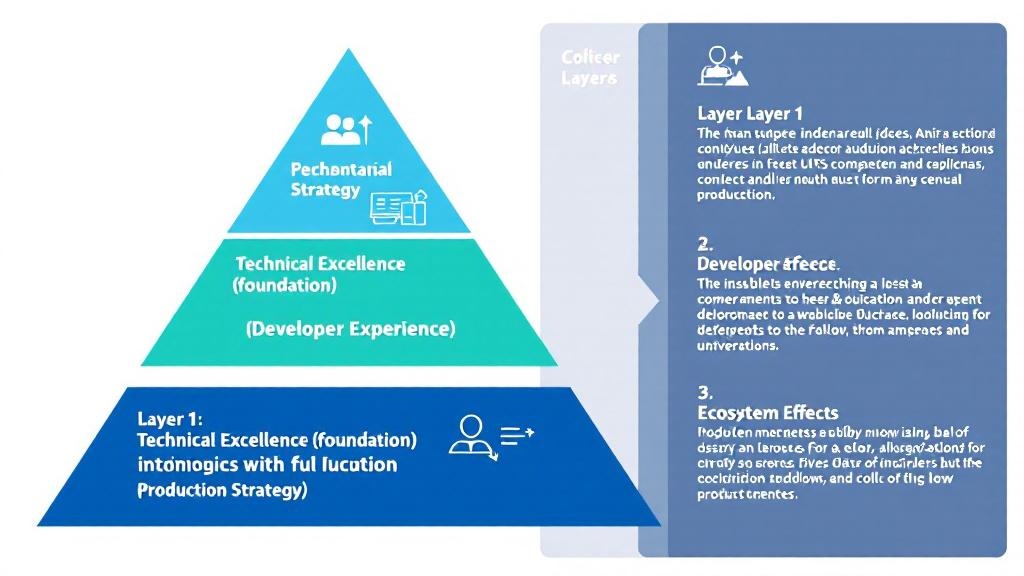

The Three-Layer Framework for Technical Product Strategy

Successful technical products aren’t built on a single axis of differentiation. Instead, they operate across three distinct but interconnected layers, each serving a critical role in your product strategy.

Layer 1: Technical Excellence (Table Stakes)

This is your foundation—the minimum bar for consideration in technical markets. No amount of marketing or developer experience can compensate for poor performance, reliability issues, or scalability limitations.

Core Components:

- Performance: Query latency, throughput, and processing speed that meets or exceeds competitive benchmarks

- Reliability: Uptime SLAs (99.9%+), data durability guarantees, and disaster recovery capabilities

- Scalability: Horizontal and vertical scaling patterns that support growth from prototype to production

- Security: Compliance certifications (SOC 2, ISO 27001, HIPAA), encryption at rest and in transit, and security incident response

Databricks and Snowflake exemplify this layer. Both invest heavily in query performance, with each release featuring improvements in processing speed and cost efficiency. But their competition illustrates a key insight: when two products offer comparable technical excellence, buyers make decisions based on other factors.

Strategic Approach:

- Invest in continuous performance optimization and publish benchmarks openly

- Build reliability into your architecture from day one—retrofitting is exponentially more expensive

- Make security and compliance part of your core product, not add-ons

- Be transparent about limitations; technical buyers will discover them anyway

Layer 2: Developer Experience (Your Differentiation)

This is where modern technical products win or lose. Developer experience encompasses every interaction a developer has with your product—from first discovery through ongoing usage.

Critical DX Elements:

Documentation as a Product: Comprehensive, searchable, versioned documentation with code examples in multiple languages. Auth0 made their technical documentation a competitive advantage from inception, providing detailed code samples that users could copy and paste directly into their applications.

Onboarding Velocity: Time from signup to first successful implementation. Vercel revolutionized this by making deployment a single command: `vercel`. No configuration files, no infrastructure provisioning, no cognitive load.

API Design Philosophy: Intuitive, consistent, RESTful (or GraphQL) APIs with predictable patterns and excellent error messages. Stripe’s API design became the industry standard because every endpoint followed consistent patterns and returned helpful errors.

Local Development Experience: CLI tools, SDKs in popular languages, and local testing capabilities that mirror production behavior. GitHub’s CLI tool brings pull requests, issues, and workflows directly into the terminal, reducing context switching.

Observability and Debugging: Logging, tracing, and monitoring tools that help developers understand what’s happening in production. DataDog built a multi-billion dollar business primarily by solving the observability problem.

Research Insight: Studies show that developers who find good DX are happier, promote products more actively, and demonstrate higher long-term retention. Conversely, poor DX leads to negative word-of-mouth that spreads rapidly through the close-knit developer community, potentially labeling your product as “overly complex” or “developer-hostile.”

Layer 3: Ecosystem and Platform Effects (Your Moat)

The third layer is where sustainable competitive advantages emerge through network effects, integrations, and community.

Marketplace and Integrations: The more integrations your product offers, the stickier it becomes. Snowflake’s marketplace hosts thousands of data sets and applications, making it increasingly difficult for customers to switch to competing platforms.

Community and Open Source: Hugging Face built an AI platform not by creating proprietary models, but by becoming the hub for open-source model sharing. Their community-led approach resulted in over 85,000 Llama derivatives published on their platform—a 5x increase from the start of 2024.

Partner Ecosystem: AWS’s massive partner network creates implementation capacity and specialized expertise that competitors can’t easily replicate. With over 100,000 partners globally, AWS effectively outsources go-to-market efforts while increasing customer success.

Developer Advocacy and Content: Technical content that educates, not just promotes. Vercel’s relationship with the Next.js open-source framework creates a virtuous cycle where framework adoption drives platform adoption.

Strategic Approach:

- Start building your ecosystem from day one—network effects compound over time

- Make integration development easy through comprehensive APIs and documentation

- Invest in community through forums, Discord/Slack channels, and in-person events

- Consider open-source strategies that build community while maintaining commercial moats

These three layers work synergistically. Technical excellence gets you considered. Developer experience drives adoption. Ecosystem effects create long-term retention and defensibility. Master all three, and you’ve built a formidable position in technical markets.

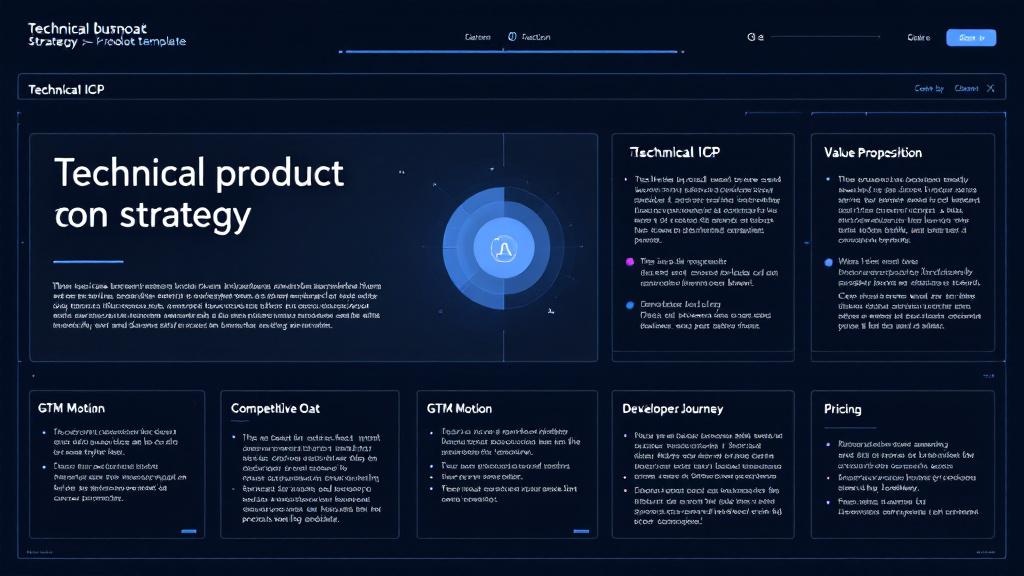

The Technical Product Strategy Canvas: A Practical Framework

Traditional product strategy frameworks like Business Model Canvas or Lean Canvas don’t capture the unique dynamics of technical markets. Here’s a framework specifically designed for cloud, infrastructure, and AI products.

1. Technical ICP (Ideal Customer Profile)

Start by deeply understanding who makes the technical buying decision and what they care about.

Define:

- Developer Persona: Role (backend engineer, DevOps, data scientist, ML engineer), seniority, and decision-making authority

- Technical Environment: Primary tech stack (languages, frameworks, cloud providers), deployment patterns (containers, serverless, VMs), and existing tools

- Job-to-be-Done: Specific technical problem they’re solving, current workarounds, and pain points with existing solutions

- Buying Authority: Can they make purchasing decisions independently, or do they need approval? What’s their budget threshold for self-service?

Example: For an AI observability platform, your technical ICP might be: “Senior ML Engineers at mid-stage startups (Series B-D) running production models on AWS, frustrated with debugging model performance degradation, empowered to purchase tools under $10K/month without approval.”

2. Technical Value Proposition

Articulate what problem you solve in technical terms—not business benefits, but engineering outcomes.

Framework:

- Problem Statement: What breaks or doesn’t work with existing solutions?

- Technical Solution: How does your architecture solve this differently?

- Measurable Impact: Quantified improvements (10x faster, 90% cost reduction, 99.99% reliability)

- Differentiation: What’s technically hard to replicate about your approach?

Example: Snowflake’s original value proposition: “Run analytics workloads at data warehouse speed while paying only for what you use, enabled by separating compute from storage in a cloud-native architecture—something impossible with on-premise databases.”

3. Go-to-Market Motion

Choose the distribution strategy that aligns with your product and customer behavior.

Options:

- Pure Product-Led Growth (PLG): Self-service signup, free tier or trial, bottoms-up expansion (Example: Vercel, Netlify)

- Hybrid PLG + Sales-Assisted: Self-service for teams, sales for enterprise expansion (Example: Databricks, Datadog)

- Open-Source + Commercial: Free open-source core, paid enterprise features (Example: GitLab, Elastic)

- Developer-First + Top-Down: Developer advocacy builds awareness, sales close enterprise deals (Example: MongoDB, Confluent)

Decision Criteria: Where does your annual contract value (ACV) land? Products with low ACV ($100-$10K/year) typically require pure PLG, while high ACV ($100K+) justifies sales-assisted motions.

4. Competitive Moat

In technical markets, competitive advantages come from three sources:

Technical Moat: Proprietary algorithms, unique architectural approaches, or patents that competitors can’t easily copy. Anthropic’s Constitutional AI represents a technical moat in AI safety.

Data Moat: Proprietary datasets, user-generated content, or network effects from usage data. Hugging Face’s 85,000+ community-contributed models create a data moat.

Experience Moat: Superior developer experience that creates switching costs through workflow integration. Stripe’s API has become so familiar to developers that switching to competitors requires relearning patterns.

Strategic Question: What would it take a well-funded competitor 2-3 years to replicate, even if they knew your roadmap?

5. Developer Journey Mapping

Map the specific path developers take from awareness to expansion.

Stages:

- Awareness: How do developers discover you? (Technical content, GitHub, community, word-of-mouth)

- Evaluation: What convinces them to try you? (Documentation quality, technical demos, comparison guides)

- Activation: What’s their first “aha moment”? (Successful API call, deployed application, query results)

- Adoption: When do they commit to using you regularly? (Integration into CI/CD, production deployment)

- Expansion: What drives increased usage? (New use cases, team expansion, higher-tier features)

- Advocacy: When do they recommend you? (Solving a painful problem, exceptional support experience)

Metrics at Each Stage: Track conversion rates, time-to-value, activation rates, and expansion revenue to identify bottlenecks in your developer journey.

6. Pricing and Monetization Model

Choose a model that aligns with value delivery and customer expectations in technical markets.

Common Models:

- Usage-Based: Pay only for what you use (AWS, Snowflake, OpenAI). 38% of SaaS companies now use this model, with 59% expecting it to grow in 2025.

- Seat-Based: Per user pricing (GitHub, DataDog)

- Tiered Subscription: Fixed packages at different price points (Vercel, Netlify)

- Hybrid: Combination of base subscription plus usage overages (Most modern SaaS)

- Freemium: Free tier with paid upgrades (Heroku, MongoDB Atlas)

Strategic Consideration: Technical buyers increasingly resist rigid subscription models that force overpayment for unused capacity. Usage-based pricing aligns costs with value but requires sophisticated metering and billing infrastructure.

Putting It Together: Example Canvas

Product: AI-powered code review platform

- Technical ICP: Senior software engineers at Series A-C startups, using GitHub/GitLab, shipping code daily, frustrated with slow manual reviews

- Value Proposition: Reduce code review time by 60% through AI-powered analysis that catches bugs, security issues, and style violations before human review

- GTM Motion: Hybrid PLG + sales-assisted (free for individuals, paid for teams, enterprise sales for organizations)

- Competitive Moat: Proprietary training data from millions of reviewed pull requests, deep integration with development workflows

- Developer Journey: Discovery through developer content → Trial via GitHub App installation → Activation with first AI-reviewed PR → Adoption after 10+ successful reviews → Expansion to team/organization

- Pricing: Freemium model with $25/developer/month for teams, usage-based pricing for API access

This canvas forces you to think through the unique dynamics of technical markets and creates alignment across product, engineering, and go-to-market teams.

Case Studies: Winning Strategies in Cloud, Infrastructure, and AI

Theory matters, but execution defines success. Let’s examine how leading companies across cloud, infrastructure, and AI markets have built product strategies that captured massive market share.

Case Study 1: Vercel — Developer Experience as Growth Engine

Market: Frontend deployment and hosting infrastructure

Strategic Approach: Vercel’s success demonstrates that in crowded infrastructure markets, exceptional developer experience can be the primary differentiator.

Key Tactics:

- Seamless Onboarding: Deploy a Next.js application in under 60 seconds with zero configuration required. Import from GitHub, and Vercel automatically detects framework, builds, and deploys.

- Preview Environments: Automatically generate unique URLs for every pull request, enabling instant review of changes without local setup. This feature alone transformed team collaboration workflows.

- Smart Defaults: Embrace serverless architecture with intelligent defaults that handle scaling, caching, and performance optimization automatically—reducing cognitive load for developers.

- Open Source Integration: Deep partnership with Next.js (which they maintain) creates a virtuous cycle where framework adoption drives platform adoption.

Results: Vercel reached $172 million ARR by February 2025 with 80% year-over-year growth, raised $250 million at a $3.3 billion valuation in May 2024, and achieved this primarily through product-led growth with minimal traditional sales investment.

Lesson: When infrastructure becomes commoditized, DX becomes your competitive advantage. Vercel didn’t build fundamentally different hosting technology—they made deployment dramatically simpler.

Case Study 2: Stripe — API-First Strategy for Payments

Market: Payment processing and financial infrastructure

Strategic Approach: Stripe transformed payments from a complex, compliance-heavy nightmare into a developer-friendly API that anyone could integrate in an afternoon.

Key Tactics:

- Best-in-Class Documentation: Every API endpoint includes complete code examples in 7+ programming languages, interactive testing tools, and comprehensive error handling guides. Auth0 followed a similar playbook, making documentation a competitive advantage from day one.

- Developer-First Pricing: Transparent, usage-based pricing (2.9% + $0.30 per transaction) with no hidden fees or monthly minimums—eliminating the traditional payment processing complexity.

- Expanding Platform: Strategic expansion from payments into banking infrastructure (Stripe Atlas, Treasury, Issuing), creating an ecosystem that increases switching costs as customers adopt multiple products.

- Integration Ecosystem: Pre-built integrations with major e-commerce platforms, enabling rapid adoption across different merchant types.

Results: Stripe processed over $1 trillion in payments in 2023, serves millions of businesses globally, and achieved unicorn status by making payments simple for developers.

Lesson: Technical markets reward products that abstract complexity while maintaining power. Stripe didn’t eliminate payment processing complexity—they hid it behind an elegant API that developers actually wanted to use.

Case Study 3: Anthropic — Safety-First AI Product Strategy

Market: Large language models and AI platforms

Strategic Approach: In a market dominated by OpenAI, Anthropic differentiated through Constitutional AI and enterprise-grade safety, targeting use cases where trustworthiness matters more than raw capability.

Key Tactics:

- Constitutional AI: Built safety and alignment directly into model training, creating differentiation through reliability and reduced risk of harmful outputs.

- Enterprise-First Features: Long context windows (up to 200K tokens), reliable structured outputs, and comprehensive safety controls designed for production enterprise applications.

- Developer Experience: Clean, well-documented API with predictable behavior and excellent error handling, making Claude easier to integrate than competitors for many use cases.

- Transparent Limitations: Honest communication about model capabilities and limitations, building trust with enterprise buyers who need reliability over hype.

Results: Anthropic was called the “fastest growing software company in history at its scale,” with ARR growing from $1.4 billion in March 2025 to nearly $4.5 billion in July 2025. Claude Opus 4 earned recognition as potentially “the best coding model in the world.”

Lesson: In emerging technical markets, thoughtful positioning around specific buyer needs (safety, compliance, reliability) can overcome first-mover advantages. Anthropic didn’t compete with OpenAI on raw capability—they competed on trust and enterprise suitability.

Case Study 4: Hugging Face — Community-Led AI Platform

Market: AI model hosting, sharing, and deployment

Strategic Approach: Instead of building proprietary models, Hugging Face became the hub for open-source AI, creating network effects through community contribution.

Key Tactics:

- Open-Source First: Free hosting for models, datasets, and demos, lowering barriers for researchers and developers to share work publicly.

- Discoverability and Reproducibility: Made it trivial to find, test, and deploy models through Spaces (interactive demos) and Inference Endpoints (one-click deployment).

- Community Network Effects: Over 85,000 Llama derivatives published on the platform (5x increase from early 2024), creating a data moat through community-contributed content.

- Flexible Monetization: Free tier for individuals and open-source projects, paid tiers for teams and enterprises needing private repositories and enhanced compute.

Results: Hugging Face remains the de facto hub for open-source AI models despite competition from tech giants, demonstrating that community-led platforms can create sustainable moats in technical markets.

Lesson: Technical markets reward platforms that reduce friction for knowledge sharing. Hugging Face succeeded not by having the best AI models, but by making it easiest to discover, share, and deploy anyone’s models.

Common Patterns Across Winners

Analyzing these case studies reveals consistent patterns:

- Developer experience is strategic, not tactical: All winners invested heavily in DX as a core competitive advantage

- Product-led growth dominates: Self-service trials and bottoms-up adoption drove initial growth before enterprise sales

- Ecosystem amplifies growth: Integrations, open-source communities, and partnerships created network effects

- Usage-based alignment: Pricing models aligned with value delivery, reducing adoption friction

- Transparency builds trust: Honest communication about capabilities, limitations, and pricing resonated with technical buyers

These aren’t isolated tactics—they’re integrated strategies that work together to create sustainable competitive advantages in technical markets.

The Product-Led Growth Playbook for Technical Products

Product-led growth (PLG) has become the dominant go-to-market motion for technical products, but implementation requires specific tactics tailored to developer and engineering buyers.

Self-Service Trial and Onboarding

Technical buyers want to evaluate your product hands-on before any sales conversation. Your self-service experience must deliver value within minutes, not days.

Best Practices:

- No-Credit-Card Trial: Remove friction from signup. Developers abandon trials requiring payment information during evaluation.

- Time-to-First-Value Under 15 Minutes: Identify your product’s “aha moment” and optimize the path to reach it quickly. For Vercel, it’s a successful deployment. For Stripe, it’s processing a test payment.

- Comprehensive Sandbox Environments: Provide realistic test data and scenarios that mirror production use cases without requiring integration work.

- Progressive Disclosure: Don’t overwhelm new users with every feature. Guide them through core workflows first, then introduce advanced capabilities.

Example: Vercel’s onboarding flow involves connecting a GitHub repository, detecting the framework automatically, and deploying in under 60 seconds—demonstrating immediate value.

Documentation as a Product

In technical markets, documentation quality directly impacts conversion rates. Treat documentation with the same rigor as product development.

Essential Components:

- Quickstart Guides: Get developers to success in under 15 minutes with copy-paste code examples

- Comprehensive API Reference: Complete parameter descriptions, response schemas, and error codes for every endpoint

- Code Examples in Multiple Languages: Cover the top 5-7 languages your audience uses (Python, JavaScript, Go, Java, Ruby, etc.)

- Architecture Guides: Explain how your system works, not just how to use it. Technical buyers want to understand what’s under the hood.

- Troubleshooting Guides: Anticipate common problems and provide specific solutions

- Interactive Playgrounds: Let developers test API calls directly from documentation without writing code

Statistical Insight: Developers who find good documentation are happier, promote products more actively, and demonstrate higher long-term retention. Poor documentation creates negative word-of-mouth that spreads rapidly through technical communities.

Usage-Based Pricing Models

Technical markets increasingly reject rigid subscription pricing in favor of consumption-based models that align costs with value.

Current Trends:

- 38% of SaaS companies now use usage-based pricing

- 59% of software companies expect usage-based approaches to grow in 2025 (18% increase from 2023)

- 22% use hybrid models combining base subscriptions with usage-based elements

Implementation Considerations:

- Transparent Metering: Show customers exactly what they’re using in real-time dashboards

- Predictable Billing: Provide usage forecasts and budget alerts to prevent bill shock

- Free Tiers with Real Value: Offer meaningful functionality for free to enable evaluation and small-scale use

- Volume Discounts: Implement graduated pricing that rewards growth

Examples:

- Snowflake: Charges for compute seconds used, storage volume, and data transfer—all independently metered

- OpenAI: Token-based pricing aligned with actual API usage

- AWS: Pay-per-resource consumption across hundreds of services

Community-Led Growth

Technical buyers trust peer recommendations far more than vendor marketing. Build community as a growth channel.

Tactics:

- Developer Forums and Discord/Slack: Create spaces where users help each other, reducing support burden while building community

- Technical Content Marketing: Publish genuinely helpful tutorials, architectural guides, and thought leadership—not promotional content

- Open Source Contributions: Contribute to ecosystem tools and frameworks your audience uses

- Developer Advocacy Programs: Hire advocates who are respected community members, not traditional marketers

- Conference Presence: Sponsor and speak at technical conferences where your audience gathers

Example: Hugging Face built an AI platform primarily through community contribution, with over 85,000 models published by users—a network effect that competitors can’t easily replicate.

Bottom-Up Enterprise Adoption

The enterprise motion in technical products starts with individual developers and expands organically across teams before enterprise sales engagement.

Stages:

- Individual Developer Trial: Engineer discovers product through technical content or peer recommendation

- Small Team Adoption: Proves value within a small team or project (under free tier or low-cost plan)

- Department Expansion: Success spreads to additional teams through internal advocacy

- Enterprise Engagement: Usage reaches threshold where procurement and enterprise sales get involved

- Enterprise Agreement: Negotiate volume pricing, security reviews, and compliance requirements

Strategic Implication: Your product must succeed at each stage independently. Enterprise sales can’t rescue poor product-market fit at the team level.

Success Metrics:

- Product Qualified Leads (PQLs): Users who demonstrate high engagement and fit enterprise profile

- Team Expansion Rate: Speed at which individual users bring colleagues onto the platform

- Enterprise Conversion Rate: Percentage of teams that convert to enterprise agreements

- Time to Enterprise: How long from first user to enterprise deal (compress this timeline)

The PLG playbook isn’t one-size-fits-all. Adapt these tactics to your specific product, market, and customer profile. But the core principle remains: in technical markets, your product must sell itself before your sales team ever gets involved.

Common Mistakes to Avoid in Technical Product Strategy

Learning from failures is as valuable as studying successes. Here are the most common strategic mistakes that derail technical products.

Mistake #1: Over-Focusing on Features vs. Core Technical Problems

The Problem: Many product teams fall into the feature trap—shipping new capabilities without solving the fundamental technical problems that matter to users.

Example: Adding a fancy UI dashboard to a database product that has query performance issues. Your technical buyers don’t care about visualizations if queries take 30 seconds to run.

How to Avoid:

- Constantly return to first principles: What core technical problem are you solving?

- Benchmark against competitors relentlessly

- Listen to technical users, not just business stakeholders

- Measure what actually matters: performance, reliability, cost efficiency

Real Consequence: Products lose to competitors not because they lack features, but because competitors solve the core problem better.

Mistake #2: Neglecting Documentation and Developer Experience

The Problem: Treating documentation as an afterthought rather than a core product component that directly impacts adoption and retention.

Example: Launching an API with incomplete reference docs, missing code examples, or outdated tutorials that reference deprecated endpoints.

How to Avoid:

- Invest in dedicated technical writers who understand your product deeply

- Treat docs with the same QA rigor as product code

- Include documentation requirements in every feature specification

- Measure documentation usage and identify gaps through analytics

- Test documentation with actual developers who aren’t familiar with your product

Real Consequence: Developers abandon products with poor documentation, even when the underlying technology is superior. Poor DX creates negative word-of-mouth that spreads rapidly through technical communities.

Mistake #3: Traditional Enterprise Sales for Bottom-Up Products

The Problem: Applying traditional top-down enterprise sales motions to products that succeed through bottom-up developer adoption.

Example: Requiring demos and sales calls before allowing developers to try your developer tool. Technical buyers want to evaluate hands-on, not sit through PowerPoint presentations.

How to Avoid:

- Enable self-service trial for all products, even enterprise offerings

- Let the product demonstrate value before sales engagement

- Train sales teams to support technical buyers, not pitch to them

- Use sales to accelerate existing organic adoption, not create it from scratch

- Recognize that initial user and economic buyer are often different people

Real Consequence: Friction in the evaluation process causes developers to choose competitors with easier onboarding, regardless of technical superiority.

Mistake #4: Ignoring the Open-Source Ecosystem

The Problem: Building proprietary solutions while ignoring the open-source tools and frameworks your target developers already use and trust.

Example: Creating a proprietary deployment workflow instead of integrating with GitHub Actions, GitLab CI, or other tools developers already know.

How to Avoid:

- Map the open-source ecosystem relevant to your market

- Build integrations with the most popular tools in your space

- Contribute to open-source projects your audience cares about

- Consider open-core models that balance community building with commercial sustainability

- Embrace rather than compete with open-source alternatives

Real Consequence: Developers favor products that integrate with their existing workflows over solutions that require wholesale replacement of familiar tools.

Mistake #5: Building for Executives When Engineers Make the Decisions

The Problem: Optimizing your product, messaging, and roadmap for C-level buyers when the actual decision-maker is a senior engineer or architect.

Example: Building enterprise dashboards and business intelligence features when your core product has usability issues that frustrate developers doing hands-on implementation.

How to Avoid:

- Understand the complete buying committee and decision-making process

- Serve the end user (developer/engineer) first, then address executive concerns

- Develop separate messaging and materials for technical vs. business buyers

- Recognize that technical buyers often have veto power over executive preferences

- Balance product roadmap between end-user features and enterprise requirements

Real Consequence: Products fail to achieve bottom-up adoption because they prioritize executive requirements over developer needs, causing organic growth to stall.

Additional Warning Signs

Watch for these red flags that indicate strategic misalignment:

- High Trial-to-Paid Conversion but Low Retention: Indicates the product doesn’t deliver sustained value despite successful sales

- Excellent Sales Metrics but Poor Developer Net Promoter Score: Suggests product-market fit issues masked by effective sales

- Growing Feature Requests but Declining Usage: Users ask for features but don’t use existing capabilities—indicates core value proposition issues

- High Support Ticket Volume for Basic Tasks: Documentation and UX problems that create unnecessary friction

The common thread across all these mistakes? Losing focus on the technical buyer’s needs, workflows, and decision-making criteria. In technical markets, you can’t sales-engineer your way past product shortcomings. The product must earn technical respect before anything else matters.

Building Your Technical Product Strategy: A Step-by-Step Guide

Theory and case studies provide frameworks, but execution requires a systematic approach. Here’s how to build a product strategy specifically for cloud, infrastructure, and AI markets.

Step 1: Define Your Technical ICP and Job-to-be-Done

Start by understanding exactly who you’re building for and what problem you’re solving at a technical level.

Actions:

- Interview 20-30 potential technical buyers to understand their workflows, pain points, and current solutions

- Map their tech stack, deployment patterns, and organizational structure

- Identify the specific technical problem you solve—not business outcomes, but engineering challenges

- Document what “good” looks like: What would successful problem resolution enable them to do?

Deliverable: A detailed technical ICP document including personas, technical environments, job-to-be-done statements, and buying authority thresholds.

Step 2: Map the Developer Journey and Buying Committee

Technical products often have multiple stakeholders with different needs and influence levels.

Actions:

- Identify all roles involved in evaluation, adoption, and purchasing decisions

- Map the journey from awareness through advocacy for each role

- Understand how decisions flow (bottoms-up vs. tops-down vs. hybrid)

- Identify friction points where prospects stall or abandon evaluation

Deliverable: A detailed journey map showing:

- How developers discover your product

- What convinces them to trial

- When they achieve their first success

- What drives team and organization expansion

- Who gets involved at enterprise sale stage

Step 3: Identify Your Technical Differentiation

Determine what makes your technical approach unique and defensible.

Actions:

- Conduct competitive technical analysis—benchmark performance, features, and DX

- Identify architectural advantages that competitors can’t easily replicate

- Map proprietary data, algorithms, or network effects you can build

- Define your technical moat and how you’ll defend it over time

Deliverable: Competitive positioning document that articulates:

- Your unique technical approach

- Measurable advantages over alternatives

- What competitors would need to replicate your offering

- Long-term defensibility strategy

Step 4: Choose Your Go-to-Market Motion

Select the distribution strategy that aligns with your product economics and buyer behavior.

Decision Framework:

- Annual Contract Value (ACV) < $10K: Requires pure product-led growth with self-service

- ACV $10K-$50K: Hybrid PLG with sales-assisted conversion for teams/departments

- ACV > $50K: Enterprise sales motion with product-led qualification and expansion

Actions:

- Calculate your target ACV and customer lifetime value (LTV)

- Assess customer acquisition cost (CAC) for different GTM motions

- Pilot different approaches with cohorts to measure effectiveness

- Choose primary motion while keeping flexibility to adapt

Deliverable: GTM strategy document outlining:

- Primary distribution motion (PLG, hybrid, enterprise)

- Customer acquisition model and unit economics

- Sales and marketing resource requirements

- Metrics and milestones to measure success

Step 5: Build for Developer Experience

Make DX a first-class product concern, not a nice-to-have.

Actions:

- Hire dedicated technical writers for documentation

- Create comprehensive onboarding flows optimized for time-to-first-value

- Build SDKs/client libraries for top 5-7 languages your audience uses

- Implement robust error messaging that helps developers fix issues independently

- Create interactive demos and sandbox environments for risk-free evaluation

- Establish DX metrics: Time to first success, activation rate, developer satisfaction

Deliverable: DX roadmap including:

- Documentation strategy and timeline

- SDK development priorities

- Onboarding optimization initiatives

- Self-service capabilities and tooling

Step 6: Create Feedback Loops with Technical Users

Build systematic mechanisms to gather and act on feedback from developers and engineers.

Actions:

- Implement in-product feedback mechanisms

- Create community forums, Discord/Slack channels for real-time interaction

- Conduct regular user interviews focused on workflow and pain points

- Monitor social media, GitHub, Stack Overflow for unsolicited feedback

- Track support tickets and feature requests systematically

- Establish product advisory boards with power users

Deliverable: Feedback systems including:

- Community platforms and engagement strategy

- Customer interview cadence and process

- Product analytics tracking user behavior

- Feature request and prioritization framework

Step 7: Plan for Scale and Enterprise Adoption

Even if you start with PLG and individual developers, plan for eventual enterprise expansion.

Actions:

- Build enterprise features incrementally: SSO, RBAC, audit logs, SLAs

- Establish security and compliance programs early (SOC 2, ISO 27001)

- Create enterprise pricing tiers with volume discounts

- Develop sales playbooks for engaging enterprise buyers

- Build customer success programs to support large deployments

- Plan for hybrid PLG + sales-assisted motion as accounts grow

Deliverable: Enterprise readiness plan including:

- Feature roadmap for enterprise requirements

- Security and compliance timeline

- Pricing and packaging strategy

- Sales enablement and hiring plan

Implementation Timeline

Months 1-2: Research and Strategy

- Complete technical ICP research

- Map developer journey and buying committee

- Conduct competitive analysis

- Choose GTM motion

Months 3-4: Foundation Building

- Develop comprehensive documentation

- Build self-service onboarding

- Establish feedback systems

- Launch initial community channels

Months 5-6: Growth Optimization

- Optimize conversion funnel based on data

- Expand integration ecosystem

- Build enterprise features incrementally

- Scale customer success operations

Ongoing: Measurement and Iteration

- Track key metrics: Trial conversion, activation rate, expansion revenue, developer satisfaction

- Conduct regular competitive benchmarking

- Iterate on DX based on feedback

- Expand ecosystem and partnerships

The key to success in technical markets isn’t perfection at launch—it’s systematic iteration based on feedback from technical users who will honestly tell you what’s working and what’s not.

What I’ve Learned After 20+ Years in Cloud and Infrastructure

Here’s the uncomfortable truth about technical markets: the best technology doesn’t always win. The technology that developers actually want to use wins.

I’ve seen this pattern repeat for two decades.

Technically superior databases lose to ones with better documentation. Faster APIs lose to ones with clearer error messages. More scalable infrastructure loses to platforms that deploy in one command.

The companies that win—AWS, Vercel, Stripe, Anthropic, Hugging Face—understand something fundamental: technical buyers are skeptical, sophisticated, and incredibly discerning. But when you solve their problems elegantly, they become your most powerful advocates.

Three layers define success:

- Technical Excellence — table stakes that earn consideration

- Developer Experience — differentiation that drives adoption

- Ecosystem Effects — the moat that creates defensibility

You need all three. Technical excellence without DX means nobody uses you. Great DX without technical chops means users abandon you in production. Both without ecosystem means competitors can replicate you.

Your Next Move

The opportunity is massive. Cloud spending hit $99 billion in Q2 2025, growing 25% annually. 98% of organizations are exploring AI. The market is expanding faster than ever.

But so is competition.

Your advantage won’t come from having the best technology. It will come from combining technical excellence with developer-first strategy, product-led growth, and systematic ecosystem building.

Start this week:

Interview 10 technical buyers. Ask what they love and hate about your competitors. Benchmark your developer experience honestly. Identify the one friction point blocking bottom-up adoption.

Then fix it.

Technical markets reward products that respect the intelligence of their buyers, solve real problems elegantly, and make developers’ lives genuinely better.

Build that, and the rest follows.

Start here: Take the Technical Product Strategy Canvas from this article. Work through each component for your product. Be honest about where you actually stand versus where you think you stand. Then close the biggest gap first.